“You are not a loan, you are not alone”

By Stanislas Jourdan, Translated by Carol Osborne

Global Voices, October 28, 2012

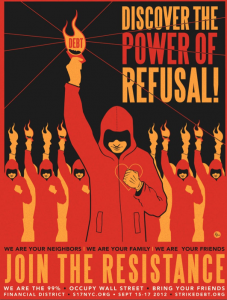

Under the slogan “You are not a loan, you are not alone,” Occupy Wall Street’s “Strike Debt” group is aiming to inject life into a resistance movement against debt repayment. The operation is gaining worldwide support, and could very well revive the protest movement which was born a year ago.

Occupy Wall Street demonstrators participating in a street-theater production wear signs around their neck representing their student debt during a protest against the rising national student debt in Union Square, in New York, April 25, 2012. Reuters/Andrew Burton

The basic premise laid out in a joint statement by Occupy Wall Street, Real Democracy Now, the 15-M movement and various organisations asserts a demand for a debt audit by the people, announcing:

“To the financial institutions of the world, we have only one thing to say: we owe you nothing.”

Mortgages, medical debts, student loans, credit cards, or even local government debts: making war against any form of illegitimate debt is the new combat for an increasing number of protest movements throughout the world.

There are already several videos online calling for debts to be wiped out:

The movement is already world-wide, but its momentum originates in the United States, where a striking reality cannot be denied: a debt strike is actually already underway there. Nicholas Mirzoeffe writes in his blog:

“- 27 percent of student loans are in default and that number is rising.

“- $1.2 trillion of mortgage debt is underwater (debt exceeds value of property) or about one-third of all properties.

“- 5 million homes have been foreclosed and 5 million more are under threat of foreclosure, meaning that owners are in default or behind on payments. 300,000 people had a foreclosure notification added to their credit report in the first quarter of this year. 27% of mortgages are seriously delinquent–ironically, a slight improvement. 300,000 more people went bankrupt.

“- The average credit card debt per household has fallen from $17, 936 in 2009 to $14,336 now: because of mass default. In 2010, credit card companies had to write off fully 10% of all debt.”

These observations are striking. But how does one go from an individual refusal to repay – often without much choice – to a collective rebellion against debt?

That is the object of the Strike Debt operation. On the operation’s official site there is even a “Debt Resisters’ Operations Manual.” This comprehensive, referenced and argumented 100-pages-long document explains how to negotiate a credit card overdraft, the risks one runs if one do not repay the student loan or the merits or lack thereof of declaring yourself bankrupt. Another section gives advice about how to best manage debts arising from medical care.

In each section, a short history of the evolution of the banking and financial system allows for a better understanding of the perversity of the financial system. It presents, for example, the collaboration between banks and universities:

“A 2006 investigation by the New York State Attorney General’s Office concluded that the business relationship between lenders and university officials amounted to an “unholy alliance.” Lenders paid kickbacks to universities based on the loan volume that financial aid offices steered their way; lenders also gave all-expenses-paid Caribbean vacations to financial aid administrators, and even put them on their payroll.”

The Strike Debt operation is aiming in particular to create solidarity between ordinary people, by reminding them that they are not alone faced with their debts:

If you are about to default on a student loan, remember that you are not alone. There are approximately 4 to 5 million other Americans that have already done so.

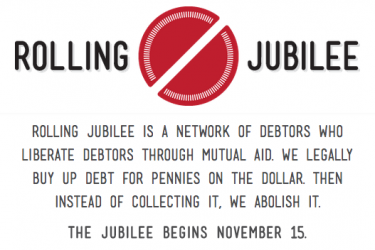

On November 15, Strike Debt will announce the launch of an operation named “Rolling Jubilee”. The idea is to create a network of mutual help, allowing those who are not indebted to legally buy up the personal debts of those who are collapsing under their repayments.

Rolling Debt Jubilee _ Public domain

The twitter feed @Occupytheory adds:

@Occupytheory: A bailout for the people by the people #undebt #n15

Towards bailing out the people?

However, beyond education and acts of solidarity, several Strike Debt activists have a more general proposal to put forward. They suggest a modern debt jubilee, meaning a massive debt cancellation.

The Australian economist Steve Keen also calls this idea a “quantitative easing for the people,” in reference to the huge support central banks give to private banks through their policy of purchasing assets. He explains his proposal on his site:

“A Modern Jubilee would create fiat money in the same way as with Quantitative Easing, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.”

Fistfullproductions has uploaded an interview with Keen:

<

The anthropologist David Graeber is one of the main sources of inspiration behind the operation. This anarchist, one of the early instigators of Occupy Wall Street, is the author of a key work published in 2011, “Debt: the first 5,000 years,” in which he explores the history of debt, and launches an appeal for a debt jubilee, which was an important custom in antiquity, as he points out in his book.

In the third edition of the review Tidal, edited by the Occupy movement, he argues:

“No doubt, readers will object: “but if you just print trillions of dollars, wouldn’t that cause severe inflation?” Well, yes, in theory, it should. But it seems the theory here is flawed, since that’s exactly what the government is doing: they’ve been printing trillions of dollars, and so far, it hasn’t had any notable inflationary effect.

(…)

“The problem is it didn’t work. Either to get the economy moving, or to increase inflation. First of all, banks did not invest the money. Mainly, they either lent it back to the government again, or deposited it in the Federal Reserve, which paid them a higher interest rate for just keeping it there than they were charging those same banks to borrow it. So in effect, the government has been printing money and giving it to the banks and the banks have just sat on it.”

So in the end why not give money directly to the people if we are now giving it to the banks?

Presented in these terms, the idea probably seems less absurd.

In the name of what type of ethics does the debt contract rule?

Going beyond economic justifications, Occupy activists completely reject the moral argument often associated with debt according to which “all debt should be repaid.” On the site The Occupied Times, Michael Richmond writes:

“What kind of morality is this morality of debt that says paying one’s debts is more important than anything else? We are seeing a regression back to Victorian times when debtors were criminalised, jailed and branded with a stigma that couldn’t be erased. And yet, everyone is in some kind of debt because the system is built on it, none more so than the entire financial sector which can only survive on public bailouts.”

How long will the strike hold? It’s difficult to predict, but it is sure that one year after the birth of Occupy Wall Street, the emergence of a global consensus around the operation is marking the start of a new era for the movement. As Astra Taylor interpreted it on September 5 2012 on the site The Nation:

“Debt, a growing number of organizers believe, has the potential to serve as a kind of connective tissue for the Occupy movement, uniting increasingly dispersed organizing efforts around a common problem (debt) as opposed to a common tactic (occupation).”

In another article on the same site, David Greaber goes as far as to wonder whether debt could trigger a revolution:

Occupy was right to resist the temptation to issue concrete demands. But if I were to frame a demand today, it would be for as broad a cancellation of debt as possible, followed by a mass reduction of working hours – say to a five-hour workday or a guaranteed five-month vacation.

By attacking debt, Occupy is attacking the basis of the system, and no longer only those who benefit from it or even their tools (austerity, bail-outs, central banks). The Occupy movement’s change in direction is certainly ambitious, difficult and resolutely more subversive. However for David Greaber, this is not the problem:

If such a suggestion seems outrageous, even inconceivable, it’s just a measure of the degree to which our horizons have shrunk.