The A.I. boom is on the verge of bursting like every other capitalist bubble.

Financialization and speculation will result in another economic crisis.

For the last month or so, investors, business gurus, and veritable Wolves of Wall Street have been discussing the massive–and growing–AI financial bubble. Speculative bubbles are nothing new in the American economy. The other imperialist countries in Europe are slightly insulated from this financialization, although not entirely. AI has been on the tip of everyone’s tongues for some time now, and many services–email, customer service, shopping sites, and even social media are full of AI chatbots or ‘virtual assistants’ which promise to ease your time on the web.

AI maximalists believe that many jobs will be replaced by this technology, and are pursuing their goal of Artificial Generalized Intelligence (AGI). AI skeptics, on the other hand, see the AI hallucinations, model collapse, and mental health crises exacerbated by this technology as evidence of the damaging characteristics of AI. In previous pieces, I have sought to explore a political-economic approach to AI/Large Language Models (LLMs). In my first article on the subject, I explored the lumpen development that characterizes our ruling class’s strategy of accumulation. In another article, I explored the military and imperialist strategies of expanding this market. This article, then, serves as an exploration of the hyperfinancialization of our economy as it relates to the AI bubble, and how this relates to the general crisis of capitalism and the moribund nature of imperialist economies today.

In order to understand the current AI financial bubble, a genealogy of this type of investment strategy is necessary. In some sense, the hyperscale data centers we see today are the descendants of the ‘business park’ and the ‘Special Economic Zone’ (SEZ). The most basic form of the SEZ that people interact with on a semi-frequent basis is the airport duty-free zone. It is an area inside the airport that looks like a mall and where travelers can benefit from tax-free purchases of perfume, alcohol, candy, clothes, books, and other kitsch items. Over the last decades, these zones have proliferated, and now there are entire areas within cities that act as SEZs with different purposes. The most extreme example is Dubai, which is not actually a ‘city’ as such; it is a cluster of different zones of accumulation based on different market niches. Dubai Internet City hosts tech and social media businesses, which all receive tax breaks and do not have to abide by health, labor, or safety standards. Dubai University City hosts satellite campuses of various European and American elite universities. The list goes on.

Business parks are oftentimes placed within SEZs, but not always; these are the places one might drive past in the suburban Midwest with call centers, tech support firms, and other tertiary, parasitic business services that thrive on the financialized economy. More often than not, the majority of office space in these business parks is empty, because its intended purpose was never to be fully stocked, bustling with firms. Rather, these can be seen as the physical investments of finance capital, when money needs to be sunk into something to protect a person or firm’s assets. Samir Amin often spoke of the need to pair urbanization with real industrialization to achieve economic development. What we have here is suburbanization, which does not relate to material production, but the proliferation of services.

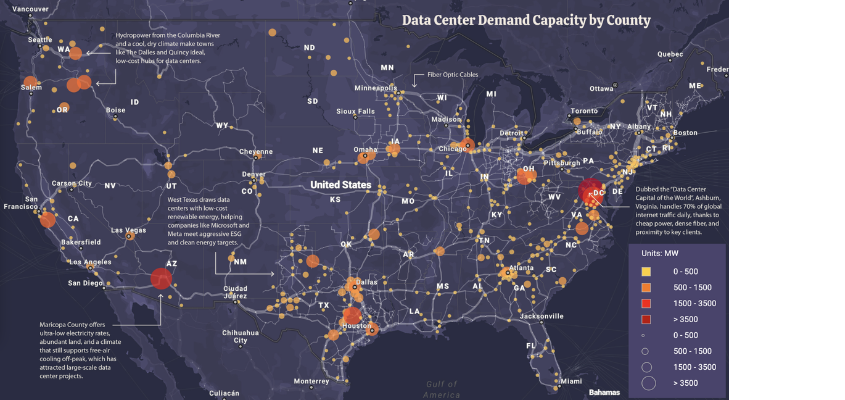

This leads us to data centers. Some of the first, smaller-scale data centers are or were located in these types of environments, where tax breaks, lax laws, and incentives for the firms operating them are common. Now, with the advent of hyperscale data centers, entire plots of land are

taken over by concrete behemoths that produce no real value or commodities into the economy and destroy the bases of the real economy: water, through extensive cooling processes; electricity, through massive inputs onto outdated grids; and humanity itself, through EMI sound pollution. The only purpose of these is to provide a physical means of ‘blowing off steam’, which is gathering in the AI financial bubble.

Obviously, the data centers provide more computing power for these AI models and serve a purpose in expanding the models through stuffing these 200,000 square feet buildings with advanced graphics processing units (GPUs) and servers, which are able to expand the ‘cloud’ computing services of a firm like Amazon Web Services or Google. Yet, when we are speaking strictly in terms of the real economy, where actual, tangible commodities are produced that have a value in society, we are left wanting. This brings us to financialization, which is an instrument of imperialist-capitalism, and evidence of the moribundity brought about by the ruling class itself.

According to Chinese scholars Cheng Enfu and Liu Baolin:

Financial monopoly capital, which has rid itself of the constraints associated with material form, is the highest and most abstract form of capital, and is extremely flexible and speculative.

The critical part of their statement—that monopoly finance capital has rid itself of the ‘constraints associated with material form’ was discussed above. The flexibility and speculative nature of this fictitious capital is what leads to something worse than ‘stagflation’ where the American economy is declining and contracting, while inflation grows and our purchasing power is printed away by the Federal Reserve. Thus, with the AI bubble valued at $40 trillion, it is easy to see how little this contributes to the real economy. The financial assets on the other hand, are staggering, and this bubble is run by an oligopoly of US tech companies and chip makers like Nvidia. While it is outside the scope of this essay, it is also plain to see that this AI bubble is part of a broader geopolitical conflict with China. For all the financial gain being made by AI profiteers, the only physical manifestation of this market are microchips and data centers.

As mentioned above, the byproducts of these data centers are environmental degradation, loss of land which could have productive uses, and a massive load added to the outdated electrical grid, for which the buck is passed on to electric bills rather than the companies operating the data center. This process describes what Syrian scholar Ali Kadri calls the ‘accumulation of waste’. Although Kadri’s main theoretical contributions focus on how ‘war is the basis of accumulation’, it can be useful to stretch his theory to this example to show that through favoring lumpen development of the tech oligarchy, the basis of accumulation is the waste of natural resources which are required in the form of land for the buildings, water for the cooling systems, and air for exhaust pumps and AC systems. The location of these data centers forms an almost circular Venn diagram with working-class and poor areas in the United States . Thus, they are composed of what Kadri calls ‘surplus populations’ or populations whose rights to life and development are sacrificed at the altar of accumulation.

In summary, data centers are the logical conclusion of a highly financialized system of accumulation that favors corporate profits, speculation, and an increasingly intangible tech market. Following the advent of the SEZ, and the business park after it, data centers are part of a long genealogy of economic lumpen development, which requires an ‘accumulation of waste’ to serve the interests of a capitalist class with an appetite for the commons previously unknown in human history.

Hanna Eid is a Palestinian American writer, researcher, and a Union electrical worker. His writing concerns mainly imperialism and anti-imperialism in West Asia and West Africa.