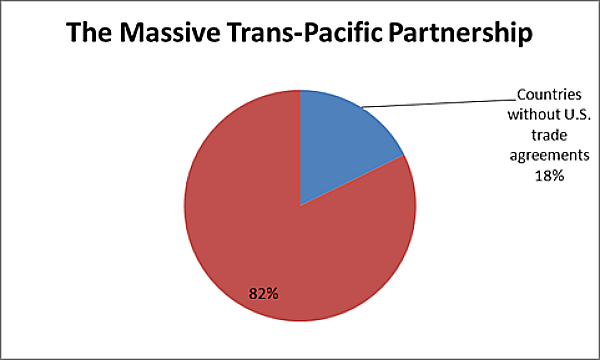

It is amazing how the elite media can be dragged along by their noses into accepting that the Trans-Pacific Partnership (TPP) can have a big impact on trade and growth. If I had a dollar for every time the deal was described as “massive,” or that we were told what share of world trade will be covered by the TPP, I would be richer than Bill Gates. The reality is that the vast majority of the trade between the countries in the TPP is already covered by trade agreements, as can be seen:

We continue to hear superlatives even as the evidence suggests the trade impact will be trivial. For example, the New York Times reported that US tariffs on Japanese cars will be phased out over 30 years. Wow! The most optimistic growth estimates show a cumulative gain by 2027 of less than 0.4 percent, roughly two months of normal GDP growth.

This doesn’t mean that the TPP can’t have an impact. It will lock in a regulatory structure, the exact parameters of which are yet to be seen. We do know that the folks at the table came from places like General Electric and Monsanto, not the AFL-CIO and the Sierra Club. We also know that it will mean paying more for drugs and other patent and copyright-protected material (forms of protection, whose negative impact is never included in growth projections), but we don’t yet know how much.

We also know that the Obama administration gave up an opportunity to includecurrency rules. This means that trade deficit is likely to persist long into the future. This deficit has been a persistent source of gap in demand, leading to millions of lost jobs. We filled this demand in the 1990s with the stock bubble and in the last decade in the housing bubble. It seems the latest plan from the Fed is that we simply won’t fill the gap in this decade.