Above Photo: Davi Carvalho/Flickr

Now that the decades of rapidly rising economic inequality have become evident to all, the center of public debate has shifted toward the question of what, if anything, can be done to reverse the trend.

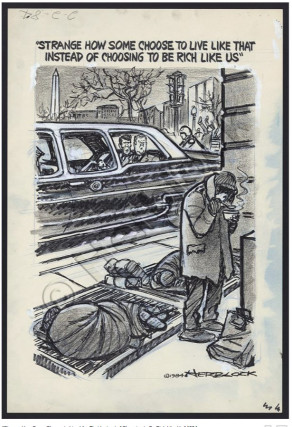

This development is most dramatically displayed in the eagerness with which newly-energized progressives have proposed ideas such as a 70 percent marginal top tax rate, a two-to-three percent annual tax on wealth, and a beefed-up estate tax. Polls show that most Americans, even many rank-and-file Republicans, dislike growing inequality and endorse, at least in the abstract, taxing the rich more. However, when it gets down to concrete action, Americans–with our insistence on “deservingness” and “just desserts”–typically back off from redistribution. We instead prefer expanding opportunities for people to get ahead, especially by broadening access to education.

Unfortunately, while increasing access would make for a more equal inequality–I’ll explain what I mean by that in a bit–it would do little to compress the ever-yawning income and wealth gaps. That is because the core problem is not making the race to the top fairer, although that is a worthy goal, but is making the results of the race to the top fairer. There, the options are even tougher.

The Race and the Rewards

Public discussions of reducing inequality have largely focused on equalizing the opportunities for people to move up, on ideas such as universal pre-K, school reform, reducing college debt, fighting discrimination, affirmative action, training programs, opportunity zones, and career mentoring. The hope is that someday the daughter of a Kentucky miner will have as much of a chance to live well as the son of a Wall Street broker, their fates determined not by circumstances, but only by ability and character.

The first problem with this strategy is its difficulty. If there is one thing almost all American parents–and grandparents (see here, and here, and here)–do, at whatever cost in time or money, is give their children and grandchildren advantages in the competition to get ahead. If, in the 1950s, that meant buying an expensive encyclopedia, so be it. (My parents did.) If in the 1990s, that wasn’t enough, because other parents were chauffeuring their kids to enrichment classes and music classes, middle class parents did that, too. (We did.) If in the 2010s, it means supporting 20-somethings in unpaid internships, parents who can, do. Because success depends on who you know as well as what you know, advantaged parents also pass on advantageous contacts. Finally, well-off parents increasingly stake their children’s first steps into the housing market, as well as generally provide them a financial safety net. Most parents stubbornly do what they can to advantage their children and they will adjust what they do as the rules of the game change to gain or maintain a head start for their kids.

Expanding educational opportunity has often been seen as a way to counteract advantages based on family affluence, but as more Americans attain more education, the standards for what is enough education go up. It used to be high school graduation, then college graduation, now increasingly a post-college degree. As the credentialed workforce expands, employers can demand more credentials of applicants for doing the same work. The family advantage gap thus remains or even widens.

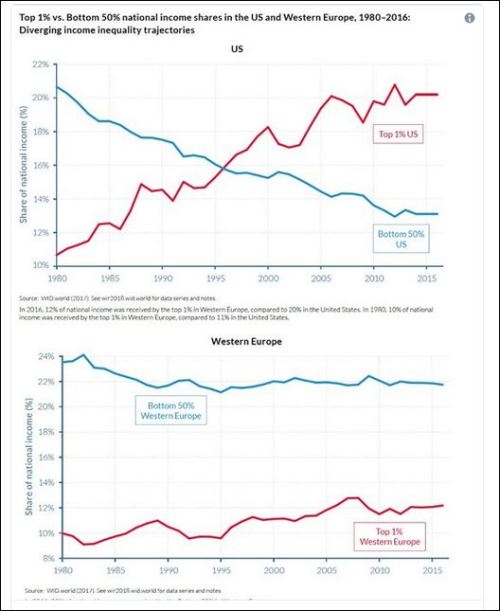

Yet, if despite all that, equal opportunity policies did succeed, they would only provide equal shots at winning the inequality race; they would not reduce inequality. As colleagues and I discussed in a 1996 book, the question, Who gets ahead?, is fundamentally different from the question, What do people get for finishing ahead or finishing behind? The U.S. does worse than most other western nations in equalizing the opportunities its citizens have to finish well in the race to success, but it does worse than all other western nations in equalizing how much its citizens get for winning, placing, showing, or losing. The gaps in how well the front ranks do compared to the ones behind them are much greater in the U.S. than elsewhere in West and they are widening (see figure below) and for no good reason.

One common illustration of the widening gap is the comparison of how much CEOs of major corporations make a year compared to average workers. In the 1950s, CEOs made about 20 times more than the typical worker; in 2017, 360 times more. Did the greater value, productivity, or worthiness of CEOs compared to the average worker multiply eighteen-fold in that period the way the income gap did? No. And inequalities in assets are much greater than that. So, if somehow the Kentucky miner’s daughter ended up running Goldman, Sachs while the Wall Street broker’s son ended up checking inventory for the Goldman, Sachs cafeteria, the degree of economic inequality would remain as is.

To deal with actual economic inequality, we need to narrow the differences in the rewards that the front-runners and those behind them get.

Alternatives

The first point to make is that alternatives are possible. To make that point, I simply reproduce a graph that has been circulating on the web for a while. In the U.S. over the last 35+ years, the top one-hundredth of Americans doubled their share of national income while the share for the bottom half of Americans was cut by about 40 percent. In Western Europe, the shares of the very rich and the bottom half stayed at about what they were in 1980. The pressures toward inequality are global, but the outcomes differ greatly–because policies make a difference.

If policies could alter American inequality some day, it would be to change the rewards of the race, not the rules of the race. Choosing such policies must address two distinct concerns regarding inequality: One, there is the inequality that involves the bottom, say, quarter of Americans falling behind middle Americans, which became evident in the 1970s and ‘80s. This is a concern not only for reasons of social justice, but also because this is the population where problems of family instability, childhood poverty, opioid addiction, and the like have concentrated. Two, there is the concern, which grew urgent in the 1990s and 2000s, about the degree to which the top 1 percent–actually the top 0.1 percent–have accumulated vastly much more of American wealth than they had before. That concentration, it is argued, is a threat to democracy specifically and to our common citizenship more broadly.

Three broad avenues are available. One is to intervene, as some countries do, in the marketplace to re-calibrate incomes: “predistribution.” Raising the minimum wage is a simple example. Another common one is to institute industry-wide wage bargaining that would give workers more leverage. Reforming the shareholder value standard for the governance of corporations is yet another. Conservative analysts point to a variety of rules and regulations that create excess “economic rent”–essentially extra income to someone beyond the true cost of providing a service or product–ranging from modest examples like requiring credentials that artificially limit supplies (such as licenses for beauticians and Ph.D.s for professors) to larger ones like city zoning that protects some landowner assets to even vaster sums garnered by corporate lobbyists working on government (pressing for long-lasting patents and copyrights, tailored tax breaks, insider deals for government contracts, and weak antitrust enforcement, for examples). Two Nobel Laureates in economics recently argued that “eliminating rent seeking and toughening enforcement of antitrust laws are ‘critical’ to reducing rising inequality.”

Second is the strategy people most argue about, redistribution through taxes. Some of these ideas specifically target the power of the one percent with, for example, higher estate taxes or higher income tax rates. The revenues are an extra benefit (and not that great). The counter-arguments include the claim that high rates would undercut high ambition (think Gates, Jobs, Musk) and the prediction that the one percent’s CPAs would find loopholes to squirrel away the loot (the “rent”) anyway. Moreover, the California experience shows that relying on taxing the very rich leads to roller-coaster rides for state revenue. Nonetheless, inequality expert economist Emmanuel Saez argues, “Tax policy is blunt, but it works” as a force for equalization.

A third strategy is to focus on generating public goods that provide more equitably what private incomes provide. Some historical American examples are public roads, K-12 education, policing, fire protection, mosquito abatement, food inspection, sanitation, and clean air (however imperfectly and unevenly they are provided). But here, too, we do far less than other advanced western nations. The obvious missing provision is universal public health insurance; another is public pre-K child care (both for its educational value and to release would-be workers). Yet other possibilities include significant public housing, free(er) higher-education, home health services for the elderly (an increasing issue), and perhaps being an employer of last resort. A key political advantage is that Americans resent universal programs less than they resent ones targeted to specific needy groups.

But how would such major public goods be paid for? As Lane Kenworthy, in a forthcoming book, and others have pointed out, the kinds of dollars needed for programs of such ambition cannot be found just among the one percent–or the five percent–even after demolishing tax shelters. Social democratic nations fund such programs through much broader taxes that many more people pay, notably the value-added tax (effectively, a national sales tax). Perhaps that is a bridge too far for taxophobic Americans. Kenworthy argues, however, that we can do it, have done it for programs like Social Security and Medicare, and argues that inevitably we will do it. The new programs and taxes will involve piecemeal, perhaps even accidental, expansions of the welfare state, which once stumbled upon, will become core and defended parts of the American Way, as Obamacare seems on the verge of becoming.

One implication of these musings is that it is going to be a lot harder, more complicated, slower, and more frustrating along the way than some of the sugar-plum visions of today’s Democratic candidates and activists.