Above photo: Jeremy Hogan/AP.

Student Debt and Young America.

Young Americans are overrun with student debt. This crisis is the culmination of waning government funding for higher education, wage stagnation, wealth inequality, and a misleading emphasis on obtaining high credentials—all leading to the financial gap between college prices and later earnings. In 2020, aggregate balances reached $1.66 trillion in 2019 dollars, 122% higher in real dollars than in 2010. Not surprisingly, the number of borrowers, the amount they owe, and the number of loans each borrower acquires, have all increased over the time period. In 2019, 18-35 year-olds with student loan debt owed nearly $35,000 on average compared to just over $28,000 (USD 2019) in 2009. Back in 2009 there were only 32 million federal borrowers; in 2019, that number swelled to 43 million.

If young Americans can hope to obtain a future coherently similar to generations before them, student debt relief is a big part of the picture. By specifically studying 18-35 year olds, we hope to highlight the serious financial obstacle that student debt poses to young adults across the geographical and demographic spectrum. This report is released as part of JFI’s ongoing Millennial Student Debt research project and focuses on student debt trends along national, state, and congressional levels for young adults 18-35 years of age in 2019. It is released in tandem with our newest public data tool, the Millennial Student Debt – Comparison Tool, which allows the user to focus on and compare higher education and debt statistics for specific geographic areas at the national, state or congressional district level.

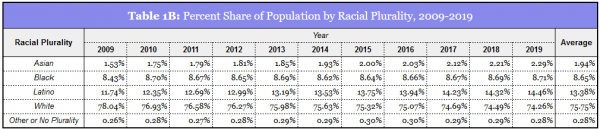

The credit bureau data used in the analysis does not include variables on race at the individual level. This analysis uses the census tract reported for borrowers matched to a race categorical variable, which took the values of Asian, Black, Latino, White, Pacific Islander, Native Alaskan, or Native American depending on the racial plurality of the census tract’s population data. Census tract data is sourced from the Census Bureau’s American Community Survey 5-year estimates for each particular year in our sample (Appendix Tables 1A and 1B).

Highlights:

- Three phenomena combined (increased enrollment, higher rates of borrowing, and larger loans) set in motion the student debt crisis we know today. Young adults in nearly all states and congressional districts, across demographic and income groups, are experiencing increases in student debt, both in absolute terms and relative to income.

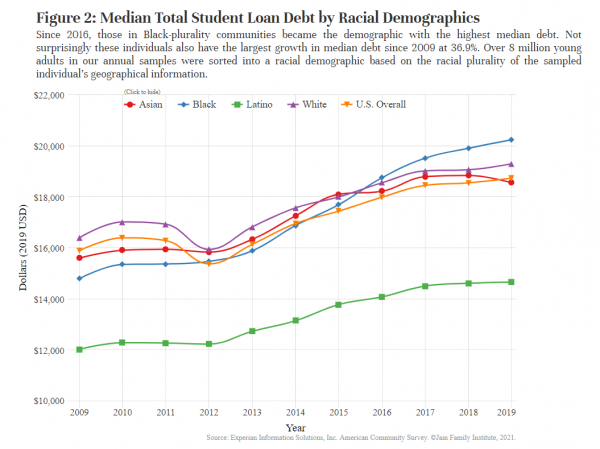

- Black communities see the largest increases over time and had the highest median student debt owed in 2019 at $20,236. Asian communities faced the worst debt inequality in 2019, with a median student debt of $18,548 while having the highest average debt balance of $38,860.

- Students of color generally pay more for higher education, have higher debt balances than white borrowers of the same income level, and have more trouble repaying their loans, so their balances increase over time rather than decrease. Because Black students across incomes take on much more student debt than white peers of the same income level, increased educational attainment is not reducing the racial wealth gap.

- Wealth inequality and the racial wealth gap are ever-present and play an important role in higher education prices, student debt take-up, growth in balances, and repayment rates. Higher debt-to-income ratios for low-income and minority students indicate that student debt is exacerbating wealth inequality and the racial wealth gap.

- Tuition and fees have increased across nearly all institutional types. Public universities have the highest growth rate in tuition and fees between 2009 and 2018 at 32%. The exception to this trend is for-profit institutions, where closures of the most expensive and predatory schools precipitated stagnant growth in costs across the entire institutional group.

- Black communities face the highest prices of all demographic groups, especially in areas where for-profit institutions outnumber public institutions. Higher prices under these circumstances are reflected in higher outstanding student loans balances.

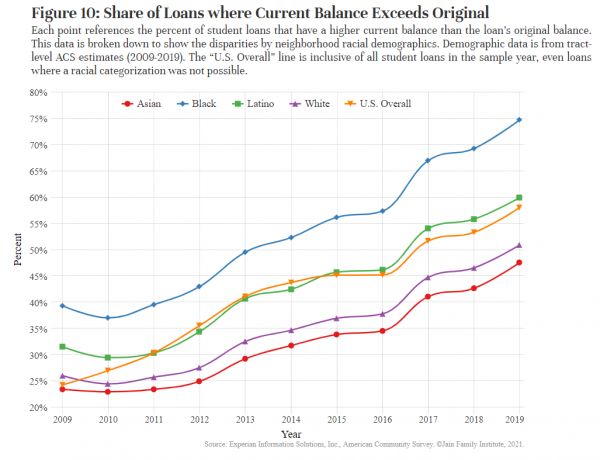

- Roughly 58% of outstanding student loans for one million 18-35 year olds sampled in 2019 had balances that were higher than the original loan amount. In 2009, that share was only 24.2%. This repayment crisis is occurring across all racial-plurality groups, but it is the worst for Black- and Latino-plurality communities in 2019, ~75% and ~60%, respectively.

- Because low- and lower-middle income communities see the worst debt-to-income ratios, they would see the largest portion of their income freed up through student debt forgiveness. Young adult borrowers in low- and lower-middle income communities would receive an outsized share of forgiveness in aggregate dollars compared to middle- and upper-income communities.

- Black borrowers across incomes would see the greatest benefits from a debt forgiveness policy, as they borrow more than white peers at the same income level and have the highest median debt balances.

About Us

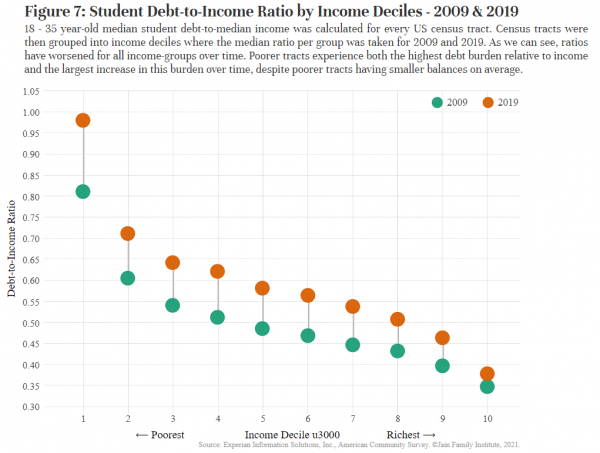

The Millennial Student Debt (MSD) research project released three reports in 2020 that focus on troubling trends in American higher education and student financing for young adults along various racial, financial, and geographic segmentation. These reports produced major findings that shed light onto the various impacts of the deepening student debt crisis: between 2009 and 2019, young borrowers have experienced ever-increasing student debt loads which are less likely to be repaid with each passing year. Borrowers living in Black- and Latino- plurality communities are being disproportionately impacted by both of these phenomena, especially when accounting for income. Low-income communities have lower debt loads than their wealthier counterparts in absolute terms, but they have drastically higher debt relative to their incomes; in 2019, debt-to-income ratios were at 98% for the lowest income decile of America compared to 38% for the richest decile. Whereas in 2009, 24.2% of student loan balances were above the origination amount, by 2019 the share had climbed to 58%. To round things out, the average age of a student loan for young adults is steadily increasing compared to ten years ago. All this comes on the heels of a promise that, post-recession, credentialization would bring higher wages. This has not materialized for most of young America.

The MSD project is run by researchers within the Higher Education Finance Initiative at the Jain Family Institute. This initiative develops pilots, studies, and research with the aim of gaining insight into the student debt crisis and finding the most high-impact interventions to alleviate debt and improve the higher education system. Our pilot and policy design within this initiative focuses on income contingent financing and debt relief.

The Jain Family Institute (JFI) is a nonpartisan applied research organization in the social sciences that works to bring research and policy from conception in theory to implementation in society. Founded in 2015 by Robert Jain, JFI focuses on building evidence around the most pressing social problems. The Phenomenal World is JFI’s independent publication of theory and commentary on the social sciences.

Contact: jficommunications@jainfamilyinstitute.org

Student Debt in 2019

Just as aggregate student debt has increased steadily since the Great Recession, so has the typical student debt load for young adults in the U.S. Between 2009 and 2019, the average total debt of 18-35 year olds with at least one student loan has increased 23% in real 2019 dollars, from just under $28,300 to $34,840. All groups have significantly higher averages than median debt loads which indicates high inequality in debt burdens. Those living in Asian-plurality communities see the highest levels of inequality, revealed by the continuously high average debt load which dwarfs their median debt. The difference between average and median debt in Asian-plurality communities is especially pronounced in comparison to other groups. All demographic groups also experienced growth in average total debt, but borrowers living in Black-plurality communities were the only major demographic group with growth over the national rate at 29%. These are the first of many unfortunate statistics in this report that reveal the racial inequities in student debt accrual, and we’ll find throughout this report that the inequalities of the student debt crisis closely reflect the inequalities of daily American life.

Racial groups in particular states and congressional districts were even worse off, as were certain groups of states (swing states) and particular regions (the Midwest and Southeast). During and after the Great Recession, there was a push to obtain postsecondary degrees and professional certificates, known as credentialization, to access higher incomes and immunity from further unemployment shocks. Millions of low-income people and people of color made the investment. And while enrollment soared due to credentialization, program persistence and completion for these students were meager; many are making loan payments on a degree that was not completed.

States and regions hit worst by the student debt crisis since 2009 were those that experienced larger diversity gains in higher education student enrollment. As student bodies have expanded to include a more ethnically and income diverse population, financial inaccess, attributable to the racial wealth gap and wealth inequality, has become more commonplace. This inaccess is only alleviated through acquiring student loans. The results were higher rates of student loan take-up per cohort as well as higher loan amounts on average per borrower, further exacerbated by increases in tuition and cost of living.

The enrollment boom during and following the recession also meant there were more students and, consequently, more borrowers than ever before. While the student loan system already had problems before the recession, these three phenomena combined (increased enrollment, higher rates of borrowing, and larger loans) set in motion its swift transition into the student debt crisis we know today. And in the 10+ years since the recession, there has been plenty of fuel for the flame: widening wealth inequality, a growing racial wealth gap, stagnant wages, predatory institutions and predatory degree programs proliferating at traditional ones, and the crisis of non-repayment. These issues impose disproportionate effects on low-income and communities of color.

While the previous graphics display data at the national level, JFI’s new Millennial Student Debt – Comparison Tool can be used to examine particular states and congressional districts to see how the student debt crisis affects demographic groups differently. As we mentioned previously, racial groups in particular states are experiencing the crisis on dramatically different terms. While this report cannot cover every state or congressional district, it provides general highlights on these localized effects of the crisis.

When ranking states on average student debt totals in 2019 and average debt growth from 2009 to 2019, states from the Northeast and Southeast more often than not come out with the highest levels in both metrics. For the highest average student debt in 2019, young adults in Washington, DC clock in at $61,596, well above the next highest average, Maryland at $40,384. Young adults in Kentucky experienced the largest increase in average student debt between 2009 and 2019 at a rate of 37.44%. The next highest was Mississippi with a growth rate of 34.17%.

Disparities in the growth rates of student debt between racial groups are severe, as seen in Table 1. While the prevailing trend across groups in every state is increased student debt balances between 2009 and 2019, at the state-level, borrowers in Black-, Latino-, and Asian- plurality communities experienced markedly higher growth rates than their peers in white-plurality communities. Interestingly, the opposite is true amongst the hardest hit racial-plurality groups within congressional districts, as seen in Table 2. For the highest growth in average debt along these racial-plurality categories, white-plurality communities in particular districts show much more pronounced growth compared to the highest growth rate among communities of color. When analyzed in tandem with 2019 average debt amounts, these pronounced growth rates may be the result of plurality-white communities catching up to the communities of color in terms of average total debt.

Debt X Income

The predicament of stagnant wages and the racial wealth gap is no more obvious than in the median income chart above. And the most important implication of stagnant incomes in relation to the student debt crisis—an increased likelihood of unbearable student loan balances. The national median income has grown 2.43% since 2009 and median student debt balance for young adults has grown 17.97%. Only three states (Alaska, North Dakota, South Dakota) and Washington, DC experienced growth in income between 2009 and 2019 which outpaced the rate of growth in student debt. For the overwhelming majority of Americans, as student debt loads and payments rise disproportionately to income, they’ll be less likely to be paid off.

In fact, for 2019’s median income, nine states had values below 2009 levels1 and in two of these states, New Jersey and Michigan, negative income growth was paired with median student debt growth of 33.0% and 29.8%, respectively. This type of interaction presents the collision of two distinct crises—expanding loan obligations and floundering solvency. Out of the 435 congressional districts, 196 reported a lower median income in 2019 than in 2009 and 85 out of those 196 experienced growths in median student debt above 20% over the same time period; shockingly, 9 congressional districts had negative income growth paired with median student debt growth over 38% (Table 3), and this trend seems to have no relationship with party dominance.

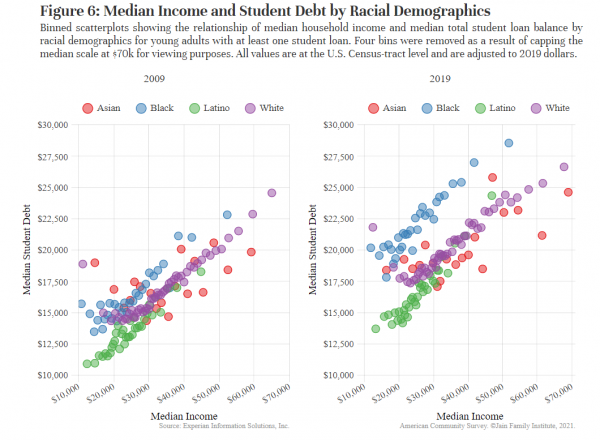

Young Americans pursue postsecondary degrees to meet the social requirement that to obtain a good job with good benefits, you need to be credentialed. No matter how expensive or loan-strapped you become, the payoff will be worth it. But the data shows otherwise: younger cohorts have made the investment, but that investment has not delivered. Instead, students are saddled with student loans they are increasingly unable to pay off, as median debt grows faster than median income across racial groups. Black borrowers suffer severe consequences of this larger trend: student debt for this group cumulatively grew by 32.5% from 2009 to 2019, while median income a mere 3.5% (Figure 5). Low-income borrowers and Black borrowers suffer disproportionate differences between income and student debt growth and therefore experience higher balances relative to income (Figure 6).

More young people depend on a postsecondary degree in order to achieve some semblance of the American dream, but the results are not materializing. In fact, the pursuit of higher education through accumulation of student debt only serves to further entrench racial wealth gaps and income inequality, as distinctly shown in Figure 5 when percentage growth of income and student debt diverge. This convergence of crises gives credence to the fact that certain groups fare worse in more ways than one: loans may be larger for borrowers of color and low-income individuals and the payoff is worse. Figure 5 alone explains rising enrollment in income-driven repayment programs, which reduce required payments to a given share of disposable income. The problem, then, is that loan balances rise over time rather than decline as they would in a standard repayment plan.

Figure 6 captures the increasing debt burden that all racial and wealth demographics experienced between 2009 and 2019. Over that time period, low-income borrowers saw the greatest increases in median student debt, regardless of racial category. The widening gap between debt burdens of borrowers in Black-plurality communities versus all other racial plurality groups became more distinct across the income distribution, but it is widest for those from middle-income census tracts. This indicates that even for relatively well-off Black borrowers, increasing educational attainment does not reduce the racial wealth gap since it requires taking on so much more student debt.

The student debt-to-income ratio2 for young Americans in most states and congressional districts has increased since the Great Recession. Debt-to-income ratios are used to indicate the financial burdens consumers are subjected to—in this case, the median outstanding educational debt divided by annual median income.3 We have calculated them for each state and congressional district as reported on the Comparison Tool, and, below, across the income distribution. All demographic groups are experiencing higher debt relative to income in 2019 compared to 2009, but it’s worst for those at the bottom of the income spectrum and for Black and Latino borrowers who systematically suffer from higher balances than their white peers at the same income level. For millions of young Americans in these groups, the burden has risen to the point that making payments is close to or completely impossible. Even if borrowers are enrolled in income-based repayment programs to defray the immediate costs of debt service, interest continually accrues and for many it capitalizes.4 The result is an ever-increasing loan balance in absolute terms but also in relation to income, which has only worsened over the last ten years.

In the graphs and tables above, one can quickly assess how the crisis has evolved over time and how low-income and borrowers of color confront harsher impacts of the student debt crisis. The lowest-income census tracts have lower balances but disproportionately higher growth rates in student debt, both in absolute value and relative to income. The lowest income decile has seen student debt grow at 27.01%, a rate significantly higher than the richest decile, which has seen debt grow 13.98% in the same period. The middle-income ranges see much less variation in debt growth than the extremes of the income spectrum. Although higher-income groups experience higher median debt burdens ($23,160 for the richest decile and $16,094 for the lowest-income decile), this difference is small compared to the difference in median incomes ($60,193 for the richest decile and $16,770 for the lowest-income decile). Thus, low-income groups experience the burden of debt much more acutely than their high income counterparts, even while holding smaller debt balances in absolute terms. And as Figure 7 illustrates, this debt burden is increasing much faster for lower-income communities than their high-income counterparts. Thus, the positive relationship between income and student debt balance in the cross section is diminishing over time, and burdens are increasing on borrowers of all incomes, but especially on those with the lowest.

We also can see the stark differences due to systemic racial inequality. Black borrowers borrow more than those of the same income level in white-plurality communities and they earn drastically less than white borrowers with the same debt loads. The visuals and tables especially inform the discussion about student debt relief and give credence to the argument that relative impact of student debt relief would be felt more intensely by the same groups that suffer disproportionately from the crisis, thereby making even blanket relief progressive.

Debt X Costs

The principal reason young Americans are in this precarious situation is that the escalating costs of obtaining a college degree are unmatched by increased wages. The higher education system was once more selective, but also highly subsidized. Public higher education systems provided a relatively privileged few access to high-quality education at a low cost of attendance. But increasingly, state governments have withdrawn institutional support for higher education, just as demand for higher education increased due to credentialization in the labor market and the disappearance of middle-class jobs that could be obtained without higher education credentials.

Colleges and universities thus came to depend more heavily on tuition-based financing: financing made possible by the federal student loan program. A proliferation of very expensive programs quickly came to fruition—programs that subsisted almost entirely on the relatively open-handed generosity of the federal system, the success of which led to the adoption of similar for-profit-like models at public institutions. As higher education prices increase with no federal or state funding to counter it, debt averages will increase. And despite the clear connection between prices and debt, there has been little government initiative over the past decade to counteract price hikes. On the contrary, the federal program has mostly accommodated tuition increases by increasing loan limits, which in turn drives a vicious cycle of enabling further tuition hikes and the proliferation of high-cost, dubiously-necessary graduate credentials.

Price trends across the country, as shown in Table 5, almost uniformly show increases in tuition and fees since the academic year 2008-2009.5 The single exception is in the for-profit and certificate programs market, which has seen decreases due to the recent spate of closures. Schools in the sector are still extremely expensive, but the most expensive of them have closed. Research indicates that higher education prices also vary depending on the make-up of the local community they serve, as well as the postsecondary institutional make-up nearby. Black communities face the highest prices of all demographic groups, especially in areas where for-profit institutions outnumber public institutions. Higher prices under these circumstances are reflected in higher outstanding student loans balances.

In the figure above, we’ve plotted the average student debt for young adults in each state against the state’s average tuition and fees.6 State marker color is according to geographical region, and the size of the state marker indicates the percent share of all higher education institutions that are public. Viewers will note right away how states cluster together on the map—states located near one another have schools which offer similarly priced programs. Additionally, some relationships are visible between the institutional make-up of the higher education market in the state (the size of the state marker) and the state’s location on the graph relative to other states: the more public institutions relative to private universities a state has, the lower the average tuition and fees paid by students and, consequently, the lower the debt burdens for young adults.

The percent changes in both of these variables have a more nuanced association. Figure 9, below, shows much more variation in debt growth than growth in higher education costs; in fact, even states with modest growth in tuition and fees experienced substantial increases in student debt over the same time period. Such a phenomenon is surely a consequence of insurmountable debt payments, and what JFI Senior Fellow, Marshall Steinbaum, dubbed a “crisis of non-repayment.” Additionally, regional clusters are less evident compared to the previous graph, nor is there any perceived relationship to institutional make-up (attributed to state marker sizes), indicating that divergent state characteristics are more likely driving much of the growth, for example, differences in labor market, state funding, or financial oversight. Regardless of higher education policy or pricing behavior, young adults now are worse off than their peers in 2009—every state has student loan growth above 10%. The disposition of indebted young Americans will not improve any time soon unless drastic policy solutions are enacted.

Debt X Repayment

While high prices and decreased funding are certainly drivers of the student debt crisis, the inability for the majority of borrowers to pay down their debt is a similar cause for concern. As referenced in our latest Millennial Student Debt report by senior fellow Marshall Steinbaum, payments on debt as a fraction of the total debt owed are getting significantly smaller over time, which is likely due to both the unbearable amount of debt as well as enrollment in income-based repayment schemes. The results are higher outstanding balances as interest accrues and longer loan life. In 2009, under 24.2% of student loans in our sample had outstanding balances above the origination amount; in 2019, that figure jumped to 58%. It’s not just evidence that student debt is increasingly less likely to be paid off, but also that making any type of substantial payment to draw down outstanding balances is getting more difficult for young Americans each year.

Just as Black Americans as well as low-income Americans suffer from higher debt growth and higher debt proportional to income, they also experience disproportionate effects of the non-repayment crisis. In Figure 10, we see that student loans taken out by young adult borrowers in Black- and Latino- plurality communities are more likely to be above the origination amount, regardless of which annual sample we analyze. Unfortunately but not surprisingly, the trend of higher non-repayment amongst Black- and Latino- plurality communities has gotten worse and outpaced that of borrowers in white- and Asian- plurality communities. Non-repayment intensifies both income inequality and the racial wealth gap by digging marginalized groups deeper and deeper into debt.

Debt X Forgiveness

The data discussed in previous sections indicates that student debt is a serious and escalating problem for young Americans across geography, race, and income. However, the disproportionate effects of the crisis means that certain groups stand to gain the most from a forgiveness policy: low-income individuals, communities of color, and states in the southeast and midwest. With rising debt levels seen in all groups and states, coupled with the current pandemic-induced recession and its unemployment effects, any forgiveness policy is also an opportunity to stimulate the economy, in addition to its egalitarian effects.

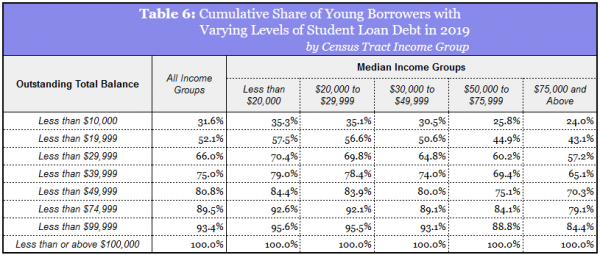

In examining the impacts that any student debt forgiveness would have on our 2019 sample population7, we model the proposal by some Senators to cancel $50,000 of outstanding balance for all borrowers. Using our dataset on young Americans with student debt in 2019, and linking it to census tract data on median incomes, Table 6 shows that 81% of young adult borrowers, or roughly 25 million young Americans, would become free of student debt with $50,000 in blanket forgiveness.8 Nearly 85% of young borrowers in the poorest communities would become free of student debt; for communities with median income above $75,000 in 2019, that share is 70%.

These numbers signal that blanket forgiveness is progressive: for lower-income communities, a cancellation of a given dollar amount of student debt means a greater proportional reduction in outstanding debt, so a cancellation of this type reduces student debt-to-income disparities between the rich and the poor (Figure 7, from section “Debt X Income”). That is more evident the higher the dollar amount of the cancellation, to the point that a total cancellation of all outstanding student debt reduces debt-to-income disparities the most.

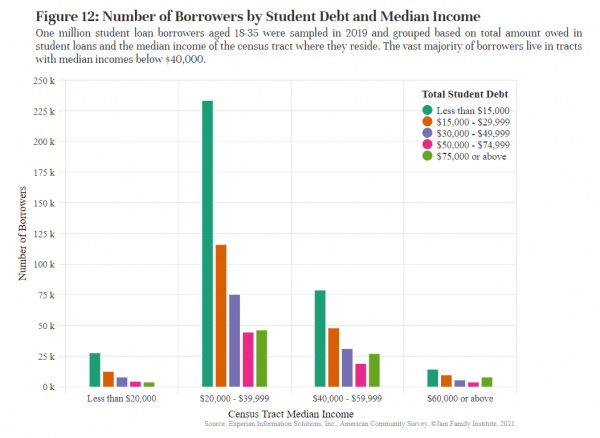

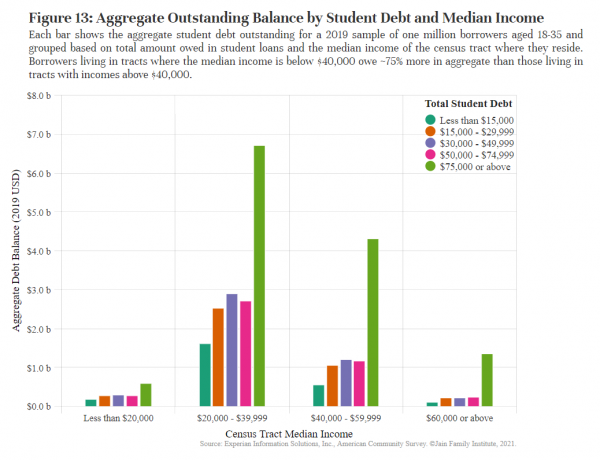

Figures 12 and 13 provide a visual graphic on the distribution of total student loans owed depending on the borrower’s median income group.9 For example, if a borrower resides in a census tract where the median income is $30,000, then that borrower would be placed in the median income group $20,000 to $40,000. Then, depending on the total student loan amount owed by the borrower, they are further categorized into the appropriate group by total outstanding student debt amount. As visualized in the charts, the sheer number of borrowers in low- and lower-middle income categories outnumber those in the higher income groups. The aggregate outstanding debt amount that young adults in low- and lower-middle income categories owe is roughly 75% more than the aggregate amount owed by young adults in middle- and upper-income categories. These facts signify that the vast majority of borrowers that benefit from forgiveness hail from low- and lower-income communities and that the overwhelming majority of the aggregate dollar amount of forgiveness, estimated to be between $800 billion and $1 trillion under a $50,000 federal forgiveness plan, would also go towards these communities.

Another way of saying this is that while average total student loan balance among all borrowers with a positive balance is an increasing function of census tract median income, having student debt at all is a decreasing function of census tract median income. Lower-income tracts (at least above the very lowest quartile) have more borrowers, both high-balance and low-balance borrowers, than high-income tracts. Thus, the greatest share of the benefit from cancellation accrues to people living in lower-income communities, relative to higher-income ones.

In addition to being viewed as an economic stimulus, politicians may see massive forgiveness as part of a “unity platform,” effecting meaningful policy across blue and red divides. Deeply red and blue states, as well as swing states, are very often present in the worst rankings along student debt statistics, like highest average balance, percentage change in balance, and debt-to-income ratios (Table 7). While debt forgiveness has received the most support from progressive Democratic politicians, millions of Americans, regardless of political affiliation, would benefit from a forgiveness policy.

As stated in the previous section, trends in repayment rates for student loans indicate that forgiveness on a massive scale will necessarily occur through IDR at the end of a long repayment term. The question of forgiveness becomes a matter of timing. As forgiveness policy currently dictates, the majority of young adult borrowers could see their student loan balances balloon for decades before they feel relief. And that relief would be staggered as various cohorts come up on their IDR finish line, either 20 or 25 years after repayment commences. But there’s a clear policy alternative: why not reap the benefits of student debt forgiveness now, when policymakers are putting forward plans for a massive economic stimulus?

As Senate Majority-Leader Chuck Schumer stated, student debt forgiveness is the “single biggest stimulus we could add to the economy.” It’s important to recall that the negative repercussions of the student debt crisis ripple out across the economy by decreasing consumption, hampering life and financial planning decisions, and burdening parents and grandparents to assume debt on behalf of a student. Improving the economic power of the 45 million Americans with student loan debt would have stimulatory effects economy wide. Low-income individuals and people of color—those hardest hit by a convergence of crises of inequality, the Covid-19 pandemic, and student debt—would see major benefits from widespread, blanket relief.

Methodology

Figures

- Figure 1: Average Total Student Loan Debt by Racial Demographics – The census tract data on sampled individuals in each year’s cross-sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individual was then categorized into a racial category depending on which racial group held a plurality of the population proportion. After categorization, lines were plotted for each major racial category to chart the average total student loan debt per group over time. Additionally, the orange line is for all individuals irrespective of racial plurality category.

- Figure 2: Median Total Student Loan Debt by Racial Demographics – The census tract data on sampled individuals in each year’s cross-sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individual was then categorized into a racial category depending on which racial group held a plurality of the population proportion. After categorization, lines were plotted for each major racial category to chart the median total student loan debt per group over time. Additionally, the orange line is for all individuals irrespective of racial plurality category.

- Figure 3: Regional Student Debt Averages and Growth Trends for Young Adults – Sampled individuals in the 2009 and 2019 cross-section were sorted into regional groups depending on which state they lived in. The average total student loan balance was calculated for each year and region, and adjusted to 2019 dollars. Then the growth rate between 2009 and 2019 was calculated for each region.

- Figure 4: Median Income by Racial Demographics – We take American Community Survey’s 5-Year estimates on the proportion of census tract population attributable to each racial group. The census tract was then categorized into a racial category depending on which racial group held a plurality of the population proportion. After categorization, lines were plotted for each major racial category to chart the median income per group of census tracts over time. Additionally, the orange line plots the median income for all census tracts irrespective of racial plurality category.

- Figure 5: Changes in Student Debt and Median Income by Racial Demographics – The census tract data on sampled individuals in each year’s cross-sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individuals were then categorized into a racial category depending on which racial group held a plurality of the population proportion. After categorization, two lines were plotted for each of the four major racial categories. The “Median Student Debt” line shows the cumulative percent change of the median total student loan balance since 2009 at the individual level. As our samples don’t have individual income levels, the “Median Income” line shows the cumulative percent change of median income since 2009 at the census tract level.

- Figure 6: Median Income and Student Debt by Racial Demographics – The census tract data on sampled individuals in each year’s cross-sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. For the four major racial groups in 2009 and 2019, individual tract’s were clustered by median total student debt balance (USD 2019) and the corresponding median household income (USD 2019) and displayed in a binned scatter plot. Each year has ~50,000 tracts, which were transformed into 135 bins.

- Figure 7: Student Debt-to-Income Ratio for Income Deciles – 2009 & 2019 – Sampled individuals were aggregated into census tracts and the median total student debt (USD 2019) per census tract was divided by the median income (USD 2019) per census tract as reported in American Community Survey data, such that each census tract would have its own student-debt-to-income ratio. Each census tract was then grouped into the appropriate income decile based off of its median income. For each income decile, the median ratio was used and reported for the median student-debt-to-income ratio for that income group. This method was performed once for census tracts in 2009 and again in 2019.

- Figure 8: Average Tuition & Fees and Student Debt, by U.S. State -Higher education tuition and fees for 2018 are adjusted to 2019 dollars and come from IPEDS files on tuition and fees for full-time first-time students for the academic year 2017-2018; average tuition and fees for the state is calculated using commuting distances around schools (more details in the bullet point below). Average student debt for 2018 is the average total student debt balance for randomly sampled individuals aged 18 – 35 in each state for 2018 and has been adjusted to 2019 dollars. The size of each state marker represents the percentage share of higher education campuses in the state which are public institutions. The color of each state marker identifies which regional group the state is part of (OBE Region Codes are sourced from the Bureau of Economic Analysis).

- Average Tuition and Fees – Tuition and Fees is the published tuition and fees for in-district students (or in-state students if there is not a distinct in-district tuition for a school) for full-time first-time undergraduate students for the entire academic year. The value displayed for each state is the mean of the average tuition and fees calculated per each census tract within the state. The average tuition and fees for each census tract is the mean of the tuition and fees of each school considered within a 45 minute drive from at least a subsection of the census tract, weighted by the enrollment number of each school. The tuition and fees per school is the following variables sourced from IPEDS: TUFEYR3. All average tuition and fees values have been adjusted for inflation using the consumer price index (CPI) deflator and are in 2019 US dollars.

- Figure 9: Percent Change in Tuition & Fees and Student Debt, by State – Percent changes in student debt and tuition and fees use the same calculations as Figure 8 to obtain the state-level average tuition and fees and student debt for 2009 and 2018, with all dollar values adjusted to 2019 dollars. The percent changes between 2009 and 2018 were then calculated and plotted against each other for each state. The size of each state marker represents the percentage share of higher education campuses in the state which are public institutions. The color of each state marker identifies which regional group the state is part of (OBE Region Codes are sourced from the Bureau of Economic Analysis).

- Figure 10: Share of Loans where Current Balance Exceeds Original – The census tract data on sampled individuals in each year’s cross-sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individual was then categorized into a racial category depending on which racial group held a plurality of the population proportion. After categorization, lines were plotted for each major racial category to chart the percentage of loans within each annual random sample that had a higher outstanding balance at the sampling date than at origination. Over 48 million loans from our loan-level cross-section sample were observed and joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. Loans with a balance of $0 were included in the calculations.

- Figure 11: Balance Growth on Outstanding Student Loans – This figure analyzes over 3 million outstanding loans in 2019, grouped by their year of origination (“vintage”). For each vintage, we show the median balance of all loans at origination and the median balance of all the same loans in 2019.

- Figure 12: Number of Borrowers by Student Debt and Median Income – This figure analyzes a 2019 cross-section sample of one million borrowers aged 18-35 with recent student loan activity and grouped by total amount owed in student loans and by median income of the census tract where they reside, as reported in the American Community Survey’s median income estimates. We calculate and show the total count of sampled borrowers for each debt and median income group. Sampled individuals without an outstanding balance were excluded in this analysis.

- Figure 13: Aggregate Outstanding Balance by Student Debt and Median Income – This figure analyzes a 2019 cross-section sample of one million borrowers aged 18-35 with recent student loan activity and grouped by total amount owed in student loans and by median income of the census tract where they reside as reported in the American Community Survey. We calculate and show the aggregate balance of student debt owed for each debt and median income group. Sampled individuals without an outstanding balance were excluded in this analysis.

Tables

- Table 1: State-level Demographic Groups with the Highest Growth in Student Debt – For the “Overall” column, we calculate the average student debt for each state using the cross-sectional samples for 2009 and 2019, adjust the dollar amounts to 2019 dollars, and find the growth rates between 2009 and 2019. The three states with the highest growth rate were reported in the first column, as well as the 2019 average student debt. For the demographic-plurality columns, census tract data on sampled individuals in each year’s cross sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individual was then categorized into a racial category depending on which racial group held a plurality of the population proportion. An average student debt was calculated for 2009 and 2019 for individuals living in each racial plurality group per state, as was the growth rate for each group between 2009 and 2019. The three states with the highest growth rate for the particular racial plurality group were reported, as well as those state racial group’s 2019 average student debt for the racial plurality group.

- Table 2: District-level Demographic Groups with the Highest Growth in Student Debt – For the “Overall” column, we calculate the average student debt for each congressional district using the cross-sectional samples for 2009 and 2019, adjust the dollar amounts to 2019 dollars, and find the growth rates between 2009 and 2019. The three districts with the highest growth rate were reported in the first column, as well as the 2019 average student debt. For the demographic-plurality columns, census tract data on sampled individuals in each year’s cross sectional sample was joined to census tract data from American Community Survey’s 5-Year estimates on proportion of population attributable to each racial group. The individual was then categorized into a racial category depending on which racial group held a plurality of the population proportion. An average student debt was calculated for 2009 and 2019 for individuals living in each racial plurality group per congressional district, as was the growth rate for each group between 2009 and 2019. The three congressional districts with the highest growth rate for the particular racial plurality group were reported, as well as those te racial group’s 2019 average student debt for the racial plurality group.

- Table 3: Congressional Districts with Negative Income Growth between 2009 and 2019 and Student Debt Growth above 38% – American Community Survey median income data for U.S. congressional districts was taken for 2009 and 2019, and adjusted to 2019 dollars. The growth rate for each district was calculated. The median student debt for young adults in each congressional district was also calculated for 2009 and 2019, and adjusted to 2019 dollars. The growth rate in median student debt between 2009 and 2019 was calculated. For all the congressional districts with a negative growth rate for median income between 2009 and 2019, the ten with the highest growth in median student debt over the same period were reported. For the Party Dominance column, either Democrat or Republican was reported depending on which party held the district the most often over the time period.

- Table 4: 2019 Median Student Debt for Young Americans and Growth since 2009, by US Income Decile – Sampled individuals were aggregated into census tracts and the median total student debt per census tract was calculated for 2009 and 2019, and adjusted to 2019 dollars. Using American Community Survey median income data on each census tract, the tracts were grouped into US income deciles and the median student debt as well as median income for each decile was taken for 2009 and 2019. The growth rate in median student debt between 2009 and 2019 was reported for each income decile, as were the 2019 median student debt and median income per decile.

- Table 5: Higher Education Costs, Academic Year 2017-2018 – The average tuition and fees for each census tract is the mean of the tuition and fees of each school considered within a 45 minute drive from at least a subsection of the census tract, weighted by the enrollment number of each school. The average tuition and fees of all the census tracts in the United States were then calculated for 2009 (academic year 2008-2009) and 2018 (academic year 2017-2018), adjusted to 2019 dollars, and then the growth rate was calculated. This process was performed with all institutional types combined into one “All School Types Combined” category, and again for the institution-specific categories.

- Table 6: Cumulative Share of Young Borrowers by Varying Levels of Student Loan Debt in 2019, by Census Tract Income Group – Using our 2019 cross-sectional sample of adults aged 18 – 35 with recent student loan activity, we looked at the distribution of individuals along the spectrum of total outstanding balance and reported cumulative percentages of the sample population as the total outstanding balance increased above $100,000. We did this for the entire sample, and also according to the median income group of the census tract where the borrower resides.

- Table 7: Worst 5 States/Territories for Troublesome Student Debt Statistics, colored by party dominance – We take the average student debt of the cross-sectional samples in 2009 and 2019 for each state/territory (the only territory included in this analysis is Washington, DC), adjust the dollar amounts to 2019 dollars, and find the growth rates between 2009 and 2019. We report the states with the highest 2019 average balance and the states with the highest growth in average balance between 2009 and 2019. To find the states with the highest student debt-to-income ratios, sampled individuals were aggregated into census tracts and the median total student debt per census tract was divided by the median income per census tract as reported in American Community Survey data, such that each census tract would have its own student-debt-to-income ratio. For each state the median ratio was reported as that state’s median student debt-to-income ratio and the five states with the highest ratio were reported. Coloring for party dominance was based on the 2020 presidential election outcomes, with swing states colored purple, wide republican-led states colored red, and wide democrat-led states colored blue.

Appendix

Table 1A: Percent Share of Census Tracts by Racial Plurality, 2009 – 2019 – Taking American Community Survey data on population proportions attributed to specific races for every census tract in the US, each tract was categorized into a racial category depending on which race held the plurality of the population proportion. In the table above, the share of census tracts in each particular year attributed to each racial plurality group is reported, as well as the average for the racial group across all years.

Table 1B: Percent Share of Population by Racial Plurality, 2009 – 2019 – Taking American Community Survey data on population proportions attributed to specific races for every census tract in the US, each tract was categorized into a racial category depending on which race held the plurality of the population proportion. In the table above, the share of total population across all census tracts attributed to each racial plurality group is reported, as well as the average for the racial group across all years.