Rail Workers Group Vows To Fight Proposed Rail Mega-Merger

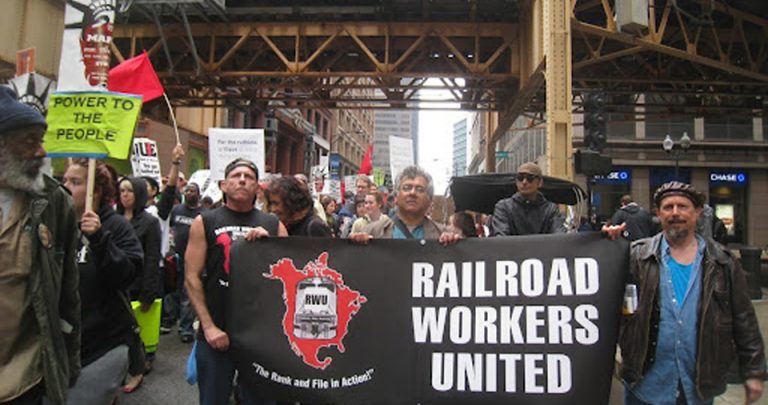

Today, Union Pacific (UP) and Norfolk Southern (NS) officially filed an application with the Surface Transportation Board (STB) requesting approval to combine the two railroads. Railroad Workers United (RWU) - a cross-craft group of North American railroad workers from all unions, crafts and carriers, promises an all-out fight to block the merger, and urges all rail workers, unions, community groups, shippers, passenger rail advocates and other stakeholders to resist what would be the largest rail merger in history. According to RWU Organizer and BMWED member from Ohio Matt Weaver, “There’s no way in hell that this acquisition will be good for anyone in Rail Labor, nor most shippers, nor the American people.”