Don’t Worry, Wall Street Journal, Health Insurers Are Profitable!

On October 21, Elevance Health (the rebrand of for-profit health insurer Anthem) announced its third quarter results. Operating revenue went up 12% from the same three-month period last year, and profits as measured by normal accounting rules rose 17%. UnitedHealth Group, the nation’s largest insurer, went one better, raising its expectations for how much profit it will make this year, as it eased Wall Street’s worries by increasing the premiums it will charge for coverage in 2026.

Please let the anxious folks at the Wall Street Journal know. They’ve been so worried.

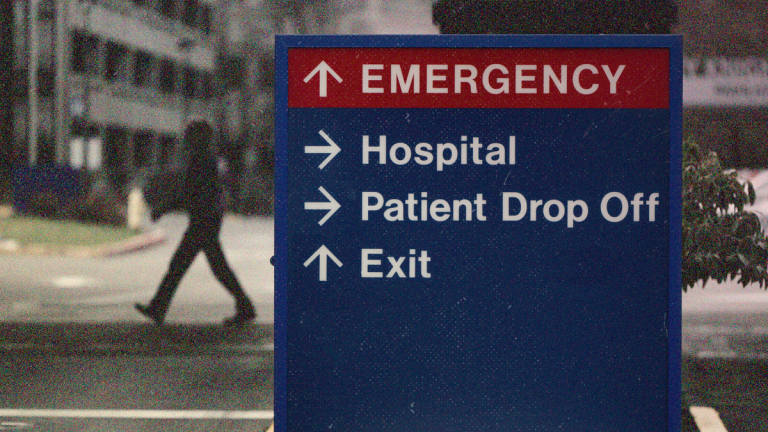

Over the past year, older Americans, low-income people who enroll in private Medicare and Medicaid insurance plans, and people covered by health insurance purchased from the Affordable Care Act exchanges have been doing something that private insurance companies and their Wall Street investors find disturbing: They’re actually going to the doctor and getting the healthcare they need.