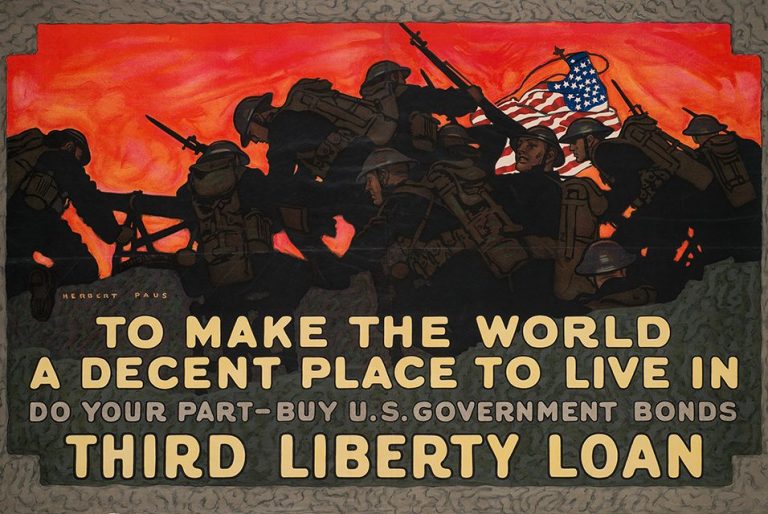

America For Sale! Everything Must Go!

The U.S. government has fallen into the hands of people who lack proper metaphors; all they know is business. The nation should be “run like a business” according to these unimaginative suits among the GOP, who haven’t read or studied enough to consider how the government might be run like anything else. The problem with this thinking is it will, by inevitably following the profit motive, lead to a terminal phase. With the House passage of President Donald Trump’s budget legislation “One Big Beautiful Bill,” the United States has reached the private equity looting stage of the metaphor.

The logic of this scheme will collapse, but it might bring us all down with it.